As you may of heard, Slack is supposedly raising a $400M equity round at a$7B valuation.

I wrote a blog post about Slack’s last announced valuation in 2016, when it was $3.8B. The tldr was that if Slack was a public company, it would be trading a 42x revenue run rate. In that blog post, I referenced the Bessemer Cloud Index, which provides perspective on what enterprise saas public companies are being traded at. The median revenue rate for these companies is 8.5x, but those public companies are growing at a much slower pace, so it was expected that Slack would earn a large multiple. That being said, I thought 42x was a bit rich.

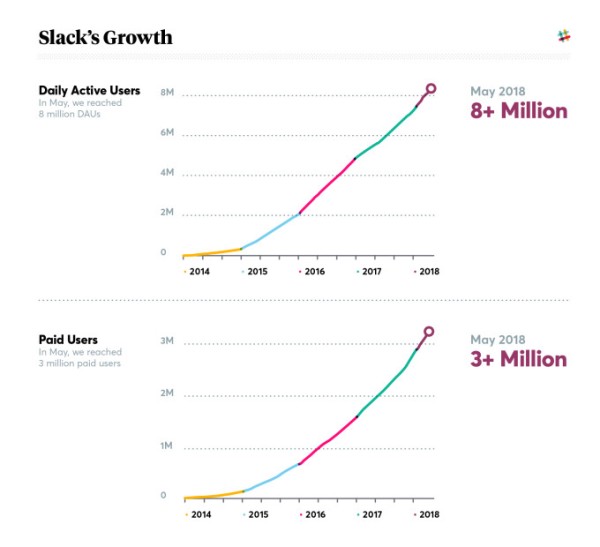

In the article mentioned in the first sentence, the had a chart: Slack has indicated they have 3M+ paid users, see below.

Per Slack pricing page, they charge between $6.67 and $15 per paying user per month.

So, based on 3M paying users, they are between $240M ($6.67/user/month x 12 months x 3M paid users) in annualized revenue run rate and $540M revenue run rate. If you split the difference, lets assume they are a $390M annualized revenue run rate.

If you take the valuation of $7B and divide it by $390M, they would be trading at 18x annualized revenue run rate.

I think 18x is a fair valuation given their grow rate, although Slack paid user growth is slowing, which is expected as the company gets larger. The closest public saas comparison I would find is Shopify, which is trading at 17x annualized revenue run rate.

THE END.