Are these the top growth startups in NYC? I don’t know, but lets take a look at some PUBLICLY available data from LinkedIn, Glassdoor and CB Insights. If you want a TLDR, scroll to the bottom.

As many of you are aware, they are so many listicles circulating online about the top companies, they are rarely data driven and read like who is the most popular, not who is best or fast growing. They typically are about driving pages views. Wanted to take a look at PUBLIC data to see if I could derive some signal from the noise.

Another lens that I thought about was, if I was going to join a startup, how would I choose which startup to join? It is a very difficult process to narrow down the list. As an example, on AngelList, there are ~2,900 startups in NYC, of which ~700 have posted a full time job on that site in the past seven days.

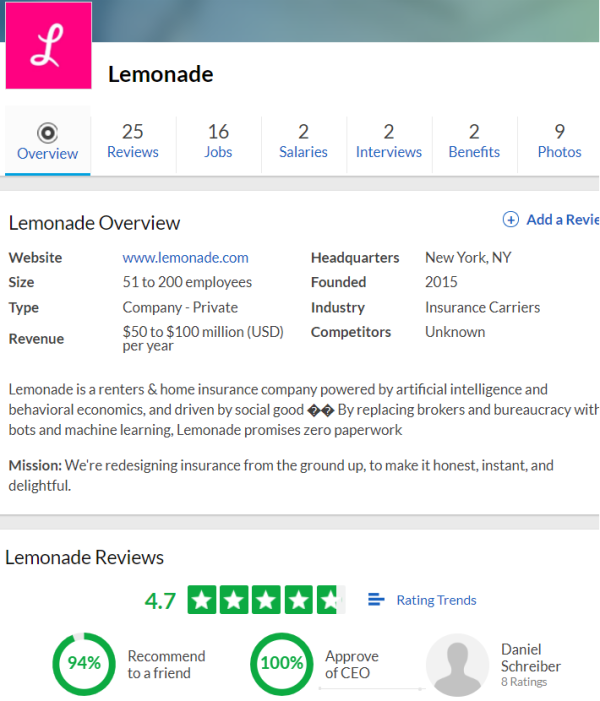

One of the public data sources is Glassdoor. If you aren’t familiar with this service, it is essentially Yelp for employees. Before you get up in arms, I realize that some disgruntled employees will post negative items on there but I think if there are enough inputs, it can provide some signal on the health of the company. Not only can you provide input on the company but on the CEO as well. For this exercise, in order to qualify, you had to have at least 20 reviews, which I thought was a large enough sample size that if there were some disgruntled employees with an ax to grind, it could be balanced by happy current/past employees but I do realize this can be gamed. Regardless, there is some signal that you can derive from this service. In addition, the startup needed a ranking of at least 4.6 or greater (max number is 5, larger the number, the better). See example below. As a side note, Glassdoor was recently acquired for $1.2B, congrats!

The other data source was LinkedIn. If you are in the tech community, LinkedIn gets trashed a lot, primarily by engineers/developers, who get a lot of unsolicited emails from recruiters, but I can see how that can be annoying. I don’t think LinkedIn has figured how to deeplink yet, you will see my tweets ranting about this 🙂 . That being said, if you are in a sales or relationship driven role, this service is invaluable. If you pay for their subscription, you get access to two data points that I used for their exercise, number of employees and growth rate. See below as an example for a NYC startup, Lemonade.

Number of employees is an important data point, as it CAN provide some signal on potential top line revenue. If you are a startup that has a clear revenue model, I assume that every employee generates at least $100K in revenue, which takes into consideration their salary, benefits and overhead (office space, taxes, electricity, etc). So in this example, I would assume that Lemonade is generating ~$9M ($100K x 91 employees) in top line revenue. I don’t know if this is accurate in this particular case but that would be my assumption. For companies who don’t have a clear revenue model, I would obviously assume no revenue. Feel free to disagree with me on this, comments are open and would like your feedback on this.

The other data point that is important is growth rate. For this exercise, I took a look at the 1 year growth rate, in the example above, it is 69%. In order to qualify for this exercise, I took a look at companies that are growing at least 20% in the past year.

Lastly, utilizing ChubbyBrain Insights (aka CB Insights), I took a look at a how much VC funding the company has raised. Two data points that you can generate some signal, total funding amount and last round of financing. If I were to join a startup, knowing when they raised their last round is critical, as it provides some signal on how much cash they have remaining. How much total funding can provide some signal as well, especially if have ownership in the company is important to you. Generally speaking, the more the company has raised, the less ownership they will provide to a new employee. So if ownership is important, you might want to take a look at this data point. For this particular exercise, I didn’t require the company be VC backed or that it has raised a new round of financing but I did provide info on that for you on Airtable (PS, I love their service)

So without further ado, here are the companies that qualified based on the all the criteria provided above (PS, if I missed you by accident, please lmk and I will update the post).

In alphabetical order:

- Augury

- BounceX

- Button

- CB Insights

- Compass

- Convene

- Dataiku

- Elite SEM

- Fundera

- Greenhouse

- InVision

- Justworks

- Kustomer

- Lemonade

- SeatGeek

- Updater

Special thanks to Bella Rubin for helping with gathering data for this post.

PS, another signal that was derived from this exercise, is looking at which VC firms were the most prevalent in backing these companies in the early days (Seed & A rounds only). See the Airtable referenced above for a link to that information. There were five firms (all NYC based) that showed up on two occasions: Lerer Hippeau, First Round Capital, Thrive Capital, FirstMark Capital and Box Group. The signal strength is a bit low as 2 out of 15 is not substantial but still wanted to highlight it.

PSS, this comment from the CEO of CB Insights is a worth highlighting. Looking at capital efficiency is good lens when taking all the data points into consideration.

nice work Shai!