As you may of heard, there was a proposition in Austin that had an impact on ride sharing, specifically on tech companies/startups Uber and Lyft. See this article if you are not familiar with the situation or want a refresher.

A lot of people in the tech community are upset about this decision, as they feel Austin is being anti-tech/startup.

The part that is disappointing is that people are being very vocal about this proposition AFTER the vote has already taken place. One thing I have witnessed in living in the Bay Area and NYC, is that the startup community, broadly speaking, aren’t very involved in local politics.

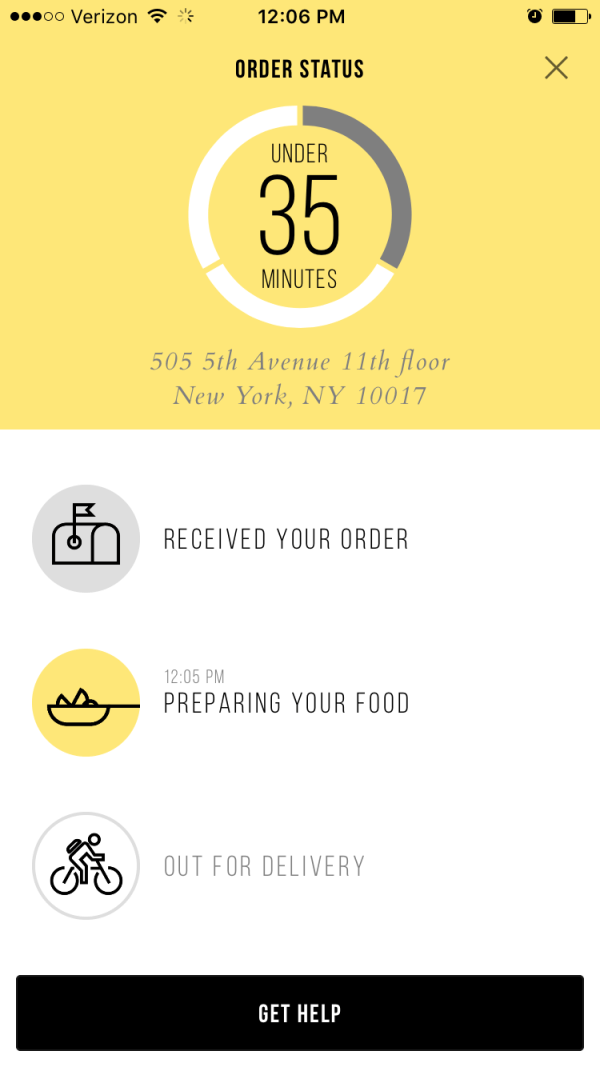

If you look at the results of the proposition, it shows you that a very small percentage of the population ultimately made the decision.

Austin has a population of almost 900K people and as you can see below, 10K people were the difference in opposing the measure that has impacted Uber/Lyft. The article that I reference above indicated that only 17% of REGISTERED voters participated in this specific proposition.

We, being the collective tech community, need to do a much better job of not only making our voices heard but connecting with those in non-tech community to influence their decisions. Sending out tweets isn’t enough, their needs to be people in the street communicating the message directly to local citizens and also calling/mailing/emailing the local/state/federal politicians.

I’m using this specific Austin situation as a recent example, so this isn’t meant to only call them out. Similar situations have happened in other cities.

Voting Results:

Austin Population: