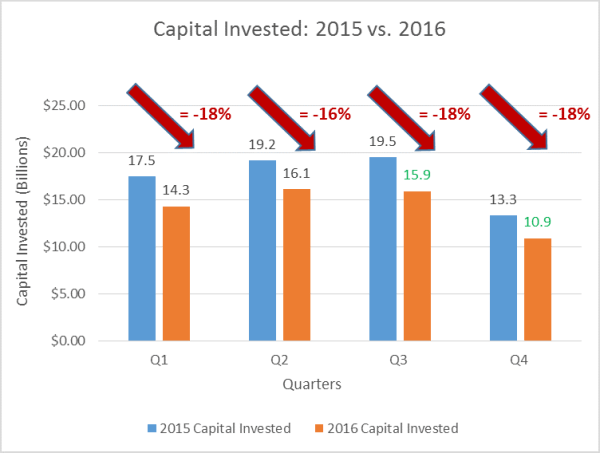

The goal of most Venture Capital funds is to drive a minimum of 3x the capital invested to their Limited Partners. The terminology that is used and most important to dig into is DPI (Distributed to Paid In).

From time to time, you will meet some audacious General Partners, who will claim they can drive 5x DPI.

Most VC funds have a 10 years life span, meaning the 3x DPI goal should be achieved within this time frame.

Lets look at the publicly available data on Pitchbook. I pulled up all VC funds that were in the 2006 vintage (meaning the fund started investing that year, so we are at the 10 year mark now). Pitchbook had return data on 27 funds. I realize that Pitchbook doesn’t have access to return data of all 2006 vintage funds, but for this exercise and to make my point, 27 is a decent sample size, considering there are 322 funds that are a 2006 vintage per Pitchbook.

Of the 27 funds:

- NONE have a 3X DPI

- ONE fund has 2x+ DPI (1 / 27 = 3.7%).

- TEN funds have a 1x+ DPI (10 / 27 = 37%)

- 17 funds has less than a 1x DPI (17/27 = 63%)

This post isn’t meant to discourage VCs or LPs, but do want to highlight that this is a very hard business to be successful at. With so many new VC firms being formed and many new LPs rushing into the VC industry, it is important to reiterate the point.

I’m not sure on the history of why 3X became the default return target by LPs, as opposed to 2.5X or 2X (will do some research on this). I realize that LPs are looking for a 20%+ IRR, which is how they get to 3x DPI goal, but it is fair to say that they have misplaced expectations. VCs are in the business of investing in outliers and therefore LPs are looking for the same, but based on this data and other available data, if you are generating 2x+ DPI, you are an outlier.

Below is the dataset that I am referencing: