A lot has already been said and written about what is happening in our tech community with regards to how Women Founders are being sexually harassed and/or assaulted. Recently, several Men have lost their jobs (careers?) for their behavior and I suspect others will too.

In addition to vocalizing how this is an issue, what actions can we take to improve things? While Women are at the center of the recent discussions, I do want to expand the conversation and include minorities in our community, as they are being impacted due to racism.

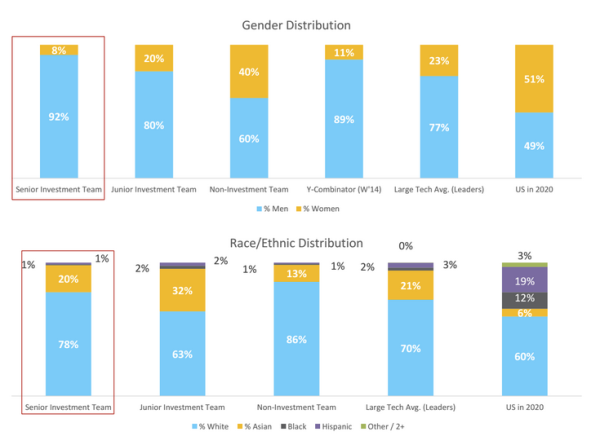

One of the most important areas we need to work on is diversifying the GPs (General Partners) of early stage VC funds. The reason I say early stage funds, is that they are usually the first to financially support a startup, at a time when the company has very little data/revenue, so the VC is making a big bet on the Founders(s). As you can see below, 92% of senior investment professional (GPs) are Men. 78% of GPs are White. The image below was via an article written by Kim-Mai Cutler in 2015.

The fact that there is a lack of diversity in the senior GP ranks, isn’t news but it is worth to highlight this again, especially for LPs (Limited Partners) who are reading this post (hopefully they are). White males are not more capable of running firms than other gender(s) or ethnicity. I believe that LPs have the most power in changing the make up of how VC firms look. We need LPs to think about diversity when they invest their capital in VC funds, so how can we help?

Specifically, we need to mentor new and diverse VC funds (aka Emerging Managers). We need to help leverage our LP rolodex to get these firms access to capital. We need to help provide high quality Founder referrals. We need to get these professionals engaged in industry events/dinners that we organize. We need to ask these firms, “how we can help”, as every firm has different needs. I don’t want to assume that everyone is looking for help or needs help but it doesn’t hurt to ask them if they need help.

If you are a VC, are you willing to share some of your LP connections? Are you willing to invite these firms into your syndicate? Are you willing to invite them to your dinners and/or speaking events?

Given that I’m based in NYC, I want to take this time to highlight diverse emerging managers based here. If you are LP and haven’t already spoken to these firms, it it worth exploring why that is and finding time to connect with them (assuming they want new LPs now or in the future).

- 645 Ventures

- AlphaPrime Ventures

- BBG Ventures

- Female Founders Fund

- Flatiron Investors

- Future/Perfect Ventures

- Human Ventures

- Lattice Ventures

- New Age Ventures

- Primary Ventures Partners

- Rucker Park

- Social Impact Capital

- SoGal Ventures

- Startup52

- Techstars IoT

- Third Kind Venture Capital

- Trail Mix Ventures

- WME Ventures

- Work-Bench

- XFactor Ventures

Please let me know if I missed any firm(s). This list is comprised of firms who meet all of the following criteria:

- HQ’d in NYC

- raising Fund I/II and/or currently investing out of Fund I/II

- General Partnership is comprised of at least one woman and/or minority. This person has to have substantial carry (which to me, means they are one of the leaders of the firm)

- Early stage investment focus (Seed/Series A)

The point of the post is not to throw LPs under the bus, but it is fair to say they could be doing more to change the diversity of VC firms. That being said, every stake holder in this community (including me) has a role that they can play in making changes that improve the makeup of VCs (and Founders). It is worth taking time to think through how you personally can be helpful, I’m still thinking through it and welcome any feedback/thoughts.

My commitment is to help the above mentioned firms. I have helped a few of them already but need to do more.

Hi Shai – Thank you for writing this post. The only way to make real progress against these abysmal statistics is for LPs to be aggressive about finding and funding emerging managers of color and women led VC firms. I wanted to make you aware of our firm as well, New Age Capital, which is a seed stage VC firm investing in tech/tech-enabled startups founded by Blacks and Latinos. We are based in NYC and currently raising our first fund. You can learn more about us at http://www.newage.vc and http://www.keepit100.vc. Feel free to connect with me as well at ivan@newage.vc. We’ve also begun to build a relationship with Dan Dehrey which we are excited about. Thanks again for this public call to action and I look forward to doing my part as well!

Humbly,

Ivan

Pingback: Sweet and sour. http://ift.tt/2jGKBaY | chumbo news